Get Early Access! *Save 50% off for one year with code: EARLYLO1

Precision Breakout Intelligence

Vantage LO1 is a licensed, modular trading software module that uses a London session lookback to inform breakout trading in the New York session. LO1 delivers a rules-based framework for disciplined execution across prop firm and cash account environments.

CORE SYSTEM DESIGN

RISK & PROP FIRM CONTROLS

PLATFORMS & ACCOUNTS

RESEARCH & VALIDATION

DEPLOYMENT & AUTOMATION*

*These features require a premium TradingView subscription ($30/month) and TradersPost account (from $50/month+ depending on the number of connected accounts)

LOW-LATENCY, CLOUD-BASED EXECUTION WORKFLOWS

Vantage LO1 is licensed trading software only. It does not provide financial advice, trade recommendations, signals, or discretionary account management. Past results are not a reliable indicator of future results. Vantage LO1 is for entertainment purposes only.

* Early Access promotional pricing is limited, time-bound, and available while capacity allows. The discount applies for six (6) months from the start of the subscription and does not apply to renewals beyond that period.

Product Features

-

Multi-Account & Firm Replication

Designed to support trade replication across multiple accounts and firms via external execution platforms.

-

Low-Latency, Cloud-Based Workflows

Optimized for cloud-to-cloud execution paths to reduce reliance on local platform uptime.

-

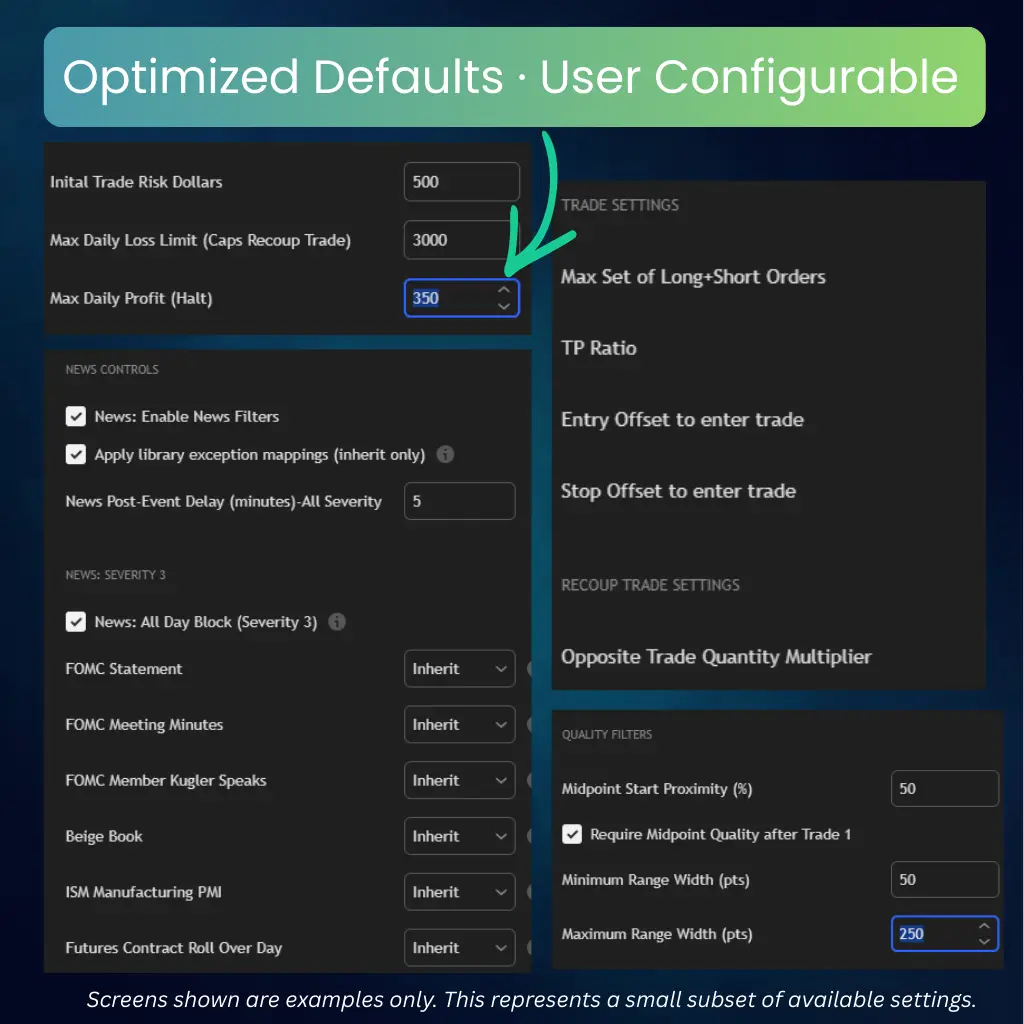

Prop Firm–Optimized Controls

Built-in risk and profit dials designed to align with strict evaluation rules and payout constraints.

-

User-Controlled Risk Management

Configurable position sizing, risk limits, and profit targets across account sizes and firm rule sets.

-

Advanced Trade-State Monitoring

Continuous monitoring and post-execution verification to help prevent orphaned or unintended positions.

Get Early Access! *Save 50% off for one year with code: EARLYLO1

Required Tools and & Third-Party Costs

-

Vantage LO1 - Monthly Subscription

Includes: full access to the Vantage LO1 TradingView indicator, ongoing strategy updates, documentation, and setup guides. We offer onboarding resources and automation support.

-

Discord Access - Free

Private Discord access is required for announcements and support; weekly news updates; and support in our knowledgeable and positive trading community.

-

TradingView - $7-$57/month for Premium + Data*

A TradingView account with a connected broker is required to run our strategy. *Data subscription is required for all subscribers (CME Group data is $7/mo). Additionally, a TradingView Premium account ($50/mo) and setting up 2-Factor-Auth (2FA) are required for automated alerts.

-

TradersPost - required for automation*

*TradersPost is required to automate trades across one or more accounts. Plans start at $50/month. Pricing can increase if you trade across multiple accounts.

-

Third Party Tools

These third-party tools (TradingView and TradersPost) are not sold by us, and you pay them directly. We'll guide you through every step of the setup for each platform if you choose to use automation.

FAQs

Our pricing reflects the current scope, performance, and level of support provided by the product, and it may evolve as the system matures. If you subscribe at a promotional or early access rate, that price is locked in for six (6) months from the date you join. After that period, pricing may adjust to reflect current rates. Any pricing changes apply to new subscriptions only. We do not increase prices without notice, and if pricing is ever updated, we’ll provide at least 30 days’ advance notice.

Subscriptions can be canceled at any time. If a subscription is canceled and later restarted, current pricing at the time of reactivation will apply.

Yes. An active TradingView market data subscription is required to use the Vantage LO1 indicator and any associated automation.

Vantage LO1 runs entirely on the TradingView platform and relies on continuous, real-time market data delivered directly through TradingView. While some brokers and prop firms provide free data through their own platforms, those data feeds do not replace TradingView’s native data connection.

TradingView offers basic CME Group futures data for:

- $7/month, or

- $84/year (annual option)

This data subscription is required to ensure:

- continuous real-time pricing,

- accurate indicator calculations,

- reliable alert triggering,

- and consistent automation behavior.

Some users choose to rely on broker-provided data instead of purchasing TradingView data. This is done entirely at the user’s own risk. Delayed, interrupted, or disconnected data feeds can result in missed signals, delayed alerts, incorrect entries/exits, or automation failures. We do not recommend this approach, and we cannot be responsible for issues that arise from the absence of an active TradingView data subscription.

Important: Data availability, pricing, and exchange requirements are controlled by TradingView and the exchanges themselves and may change. Users are responsible for maintaining an active data subscription that meets TradingView’s requirements.

The total cost depends on how you choose to use the software (indicator-only vs. automation). Below is a breakdown for clarity.

Core Required Costs (All Users)

- Vantage LO1 subscription

- Price depends on current promotions or discounts at signup

- Your initial subscription price is locked for the first six (6) months

- After six months, the subscription price increases to $499/month

- TradingView CME Group data

- $7/month or $84/year (required for all users)

Indicator-Only Use (No Automation)

If you use Vantage LO1 as an indicator only:

- Vantage LO1 subscription

- TradingView CME Group data ($7/month)

- Total additional monthly cost beyond LO1: ~$7/month

- Discord access: required, but free

Automation Use (Alerts + Auto-Execution)

If you choose to automate:

- Vantage LO1 subscription

- TradingView CME Group data ($7/month)

- TradingView Premium (required to enable alerts): ~$50/month

- TradersPost (automation execution platform): ~$50/month

Estimated additional monthly automation costs:

~$107/month (in addition to your Vantage LO1 subscription)

Important Notes:

- All third-party services (TradingView, TradersPost, exchanges) set their own pricing and terms, which may change at any time.

- We do not control third-party pricing, billing, or availability.

- Users are responsible for maintaining active subscriptions required for their chosen usage.

Yes. We regularly offer promotions to help new users get started with Vantage LO1. Any active promotion will always be listed clearly on our pricing page.

- Promotional codes apply to first-time subscriptions only

- Each promotion code may be redeemed once

- Promotional pricing is valid for six (6) months from the start of your subscription

- After the promotional period, your subscription will renew at the current standard rate

- Promotion codes may be limited in quantity or available for a limited time

If you cancel your subscription and later return, promotional pricing does not reapply and current pricing will be in effect.

* Promotion availability, duration, and eligibility will always be clearly communicated at the time an offer is made.

We offer a referral program to reward users who help grow the Vantage Stack community.

When someone you refer becomes a paying subscriber, you earn 10% of their subscription revenue, credited directly toward your own monthly subscription. If your referral credits exceed your subscription cost in a given month, any additional amount will be paid out to you directly.

Referral rewards apply for as long as the referred user remains an active subscriber. Referral eligibility, tracking, and payout details may evolve over time as the program scales. Any material changes will be communicated clearly.

Vantage LO1 supports TradingView and is compatible with Tradovate and Rithmic environments. Automation workflows can be configured using TradingView alerts and third-party execution platforms.

Yes. LO1 is informed by extensive research, historical backtesting, and forward testing. Testing focuses on consistency, risk-adjusted performance, and operational reliability rather than overfitted results.

Membership includes access to a comprehensive documentation library with written guides, videos, and platform-specific setup instructions covering installation, configuration, and monitoring.

LO1 includes context-aware safeguards designed to account for scheduled news events, holidays, and abnormal liquidity conditions, helping avoid structurally unfavorable environments.

Due to the nature of licensed trading software, no refunds are issued. You may cancel at any time, retain access through the remainder of your billing period, and you will not be billed again after cancellation.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Optio, neque qui velit. Magni dolorum quidem ipsam eligendi, totam, facilis laudantium cum accusamus ullam voluptatibus commodi numquam, error, est. Ea, consequatur.

* Early Access promotional pricing is limited, time-bound, and available while capacity allows. The discount applies for six (6) months from the start of the subscription and does not apply to renewals beyond that period.

Important Disclaimer & Risk Disclosure

Vantage Stack, LLC (“Vantage Stack,” “we,” “us,” or “our”) provides licensed trading software, analytical tools, documentation, and educational content for informational and educational purposes only. Vantage Stack is not a registered investment adviser, broker-dealer, commodity trading advisor (CTA), commodity pool operator (CPO), futures commission merchant (FCM), or introducing broker, and does not provide investment advice, trading advice, or personalized recommendations.

Nothing provided by Vantage Stack constitutes, or should be construed as, investment advice, financial advice, trading advice, or a recommendation to buy, sell, or hold any security, futures contract, derivative, or financial instrument. All information and software are provided on a general, non-personalized basis and do not take into account your individual financial situation, risk tolerance, or investment objectives.

Trading futures, derivatives, and leveraged instruments involves substantial risk and is not suitable for all individuals. It is possible to lose some or all of your invested capital, and in some cases more than your initial investment. The majority of retail traders lose money. You should carefully consider your financial condition, experience, and risk tolerance before engaging in any trading activity and consult with a qualified financial professional if appropriate.

There is no assurance that any trading strategy, system, indicator, methodology, or software will be profitable or will not result in losses. Past performance, whether actual, simulated, or hypothetical, is not indicative of future results.

Any performance data, backtesting results, simulations, trade examples, or hypothetical scenarios shown or referenced are provided solely for illustrative purposes and have inherent limitations. Simulated or hypothetical results do not represent actual trading, do not reflect real-world execution conditions, and may not account for factors such as liquidity constraints, slippage, commissions, latency, platform outages, order rejections, or market volatility. No representation is being made that any user will or is likely to achieve profits or losses similar to those shown.

Testimonials, reviews, statements, or examples presented on this website or in any Vantage Stack materials reflect individual experiences and opinions and may not be representative of the experience of other users. Testimonials are not guarantees of performance or success and should not be relied upon as predictive of future results.

Vantage Stack software may integrate with or rely on third-party platforms, brokers, exchanges, execution services, data providers, automation tools, or infrastructure providers. Vantage Stack does not control, and is not responsible for, the performance, availability, accuracy, reliability, pricing, or policies of any third-party services.

All trading decisions, risk management decisions, execution choices, and outcomes are solely the responsibility of the individual user. By accessing or using Vantage Stack software, content, or services, you expressly assume all risks associated with trading and software usage.

To the fullest extent permitted by law, Vantage Stack, LLC, its members, managers, officers, employees, contractors, affiliates, and representatives shall not be liable for any direct, indirect, incidental, consequential, or special damages, including but not limited to trading losses, lost profits, loss of data, system failures, delays, execution errors, platform outages, or technical malfunctions, arising from or related to the use of our software, content, or services.

Past performance regarding security futures products, where applicable, is subject to the following Risk Disclosure Statement for Security Futures Products issued by the National Futures Association.

All software, content, and services are provided “as is” and “as available,” without warranties of any kind, whether express or implied.